Financial Qualification which have a less than perfect credit Score

In this article

- What is actually a good credit score?

- Types of Mortgage loans

- Home loan Certification which have a bad credit Rating

There are numerous reason why you really have a good lower credit rating. You can even not experienced enough time to establish an effective credit history. Ironically, people without a lot of financial obligation have lower results than people that have higher costs however, make minimal money on time. Or, there are those who are who’ve had economic dilemmas in the for the past. You happen to be during the finest shape today, but your FICO get has not a bit retrieved but really.

Luckily you still is generally eligible for a good financial, despite a bad credit get. Your credit score is the one economic factor that lenders have a tendency to feedback with your complete obligations, downpayment, employment/earnings records or any other fundamental indications of monetary health. Of course, a top credit history is effective whenever applying for a mortgage loan. not, a reduced get shouldn’t discourage you against seeking to if you believe you are prepared order your very first household or change in order to a larger assets throughout the Atlanta, GA area.

What is good credit?

loans for bad credit Putnam AL open today

The following is a variety of just how most mortgage lenders will determine if the FICO score are a beneficial, bad or someplace in anywhere between:

There are some Atlanta home buyers whom get meet the requirements having credit scores as little as five-hundred. It depends with the bank, the sort of home loan and the almost every other monetary points given that indexed a lot more than. Lenders tend to remark what you that assist the thing is that a mortgage service which is perfect for the money you owe.

Version of Mortgages

There are certain more home loan applications that promote a great deal more lending products to own consumers which have less than perfect credit score. Be sure and ask their bank on hence program(s) you happen to be qualified to receive because the a house client. Below are a few criteria to look at:

FHA Mortgage-Property visitors can get qualify for an enthusiastic FHA real estate loan that have a credit rating as low as 500, as long as they lay no less than 10% upon the house or property. Or even, at least credit score out of 580 is required into lowest it is possible to FHA down payment regarding 3.5%.

Va Loan-The minimum credit rating having an effective Va financing could possibly get cover anything from 580-620, with respect to the bank. A great Virtual assistant mortgage borrower is qualify for a no down-payment financing. Yet not, Va loans are just open to productive military service people, resigned experts and you may enduring spouses just who meet specific eligibility requirements.

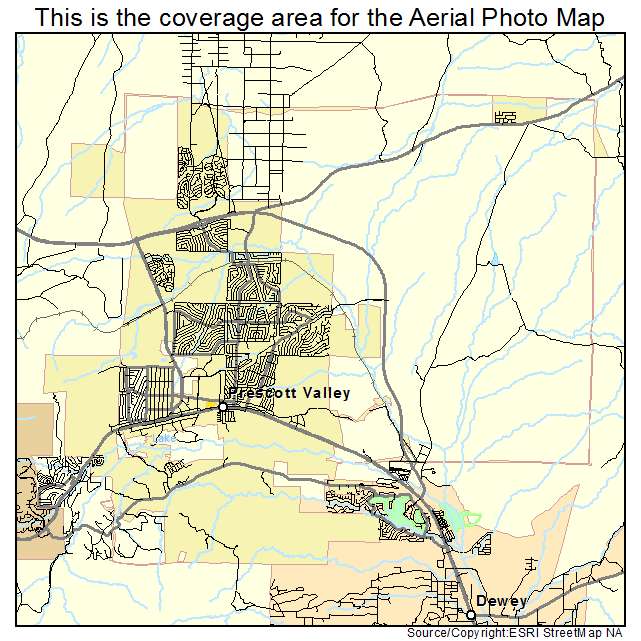

USDA Financing-Such fund are around for low-to-medium earnings individuals when you look at the approved rural section. Actually, you will find several Georgia areas away from Atlanta you to definitely meet the geographic qualifications requirements. A minimum credit rating off 640 can be necessary.

Conventional Financing-Individuals that have modest-to-a good credit score is also be eligible for a normal home mortgage with a great credit history out-of 620 or maybe more.

Almost every other Reduced-Borrowing Financing Options-There are more mortgage software on the market such as for example Freddie Mac Domestic You can and Fannie mae HomeReady that exist to help you low-to-moderate borrowing consumers. This type of software basically wanted a minimum credit rating regarding 620. After that, you will find non-qualified mortgages (Non-QMs) that don’t qualify for antique or government-supported financing. These may simply need the absolute minimum deposit regarding five-hundred-580, depending on the lending company as well as how far risk he is willing to just take.

Getting your most other earnings under control is beneficial to overcome a reduced credit score. If you can generate a top downpayment, reveal a strong a job/income history, has money in to your bank account and have now the lowest loans-to-income (DTI) proportion, you may still have the ability to qualify for an excellent household loan. A lesser credit rating can lead to higher rates of interest, that’s okay when you can easily pay the monthly premiums. You’re in a position to refinance your house mortgage throughout the future after you qualify for a lower life expectancy home loan rate.

Whatever the the money you owe, it never ever affects to speak which have an enthusiastic Atlanta home loan company so you’re able to discuss the options. Discover and that financial programs could be available to choose from and wade through the mortgage pre-acceptance technique to see if your be considered. This may allows you to understand how far family you might pay for and ensure that financing is solid when you find yourself ready to begin searching for services and you can and come up with buy offers. You are able to find a beneficial financial now, even if you possess a bad credit rating!For more information on mortgage loans and you can low-borrowing from the bank lending products to possess homebuyers within the Atlanta GA, contact Moreira Cluster | MortgageRight today.