This is basically the greatest credit history getting whenever getting into a different sort of financing

203(b): FHA’s unmarried family members system that offers financial insurance coverage in order to lenders to avoid the latest debtor defaulting; 203(b) can be used to invest in the acquisition of brand new or present you to definitely in order to four nearest and dearest casing; 203(b) covered fund are known for demanding a decreased down payment, flexible being qualified guidance, limited charges, and you will a threshold on the restrict amount borrowed.

203(k): it FHA financial insurance coverage program permits homebuyers to invest in the purchase of a house plus the price of its rehabilitation courtesy just one mortgage.

“A” Mortgage otherwise “A” Paper: a credit history the spot where the FICO score is 660 otherwise significantly more than. There are no later mortgage payments within good twelve-day several months.

ARM: Adjustable Speed Mortgage; a mortgage at the mercy of changes in rates of interest; when prices change, Case monthly installments increase otherwise drop off during the durations influenced by this new lender; the alteration inside the monthly payment matter, yet not, is often subject to a cover.

Most Prominent Percentage: money reduced to the financial plus the based percentage matter made use of myself contrary to the loan dominant so you’re able to shorten the distance of your mortgage.

Adjustable-Price Home loan (ARM): a mortgage without a predetermined rate of interest. Also called adjustable mortgages (AMLs) otherwise adjustable-price mortgage loans (VRMs).

Modifications Directory: the fresh new composed industry directory always estimate the rate out-of an arm during the time of origination or improvement.

Changes Interval: committed between your interest change and the monthly payment to have an arm. The newest period often is every one, around three otherwise 5 years according to the index.

For the life of the loan the pace vary according to the list rates

Amenity: an element of the house otherwise property you to definitely functions as a good advantage to the customer but that’s not required so you can their use; is pure (such as for example place, trees, water) or people-made (such as for example a pool or garden).

Western Society regarding Domestic Inspectors: the latest Western Community off Home Inspectors was an expert organization of independent household inspectors. Phone: (800) 743-2744

Amortization: a fees bundle which enables one to lower your loans gradually courtesy monthly payments. The fresh new payments may be prominent and you will desire, or desire-simply.

Apr (APR): a way of measuring the expense of credit, indicated as the an annual price. It provides notice and also other costs. Because every lenders, because of the federal laws, proceed with the exact same laws so that the reliability of yearly fee rates, it gives consumers with a good reason behind researching the cost out-of financing, along with mortgage plans. Annual percentage rate was a high rate compared to the easy focus of your home loan.

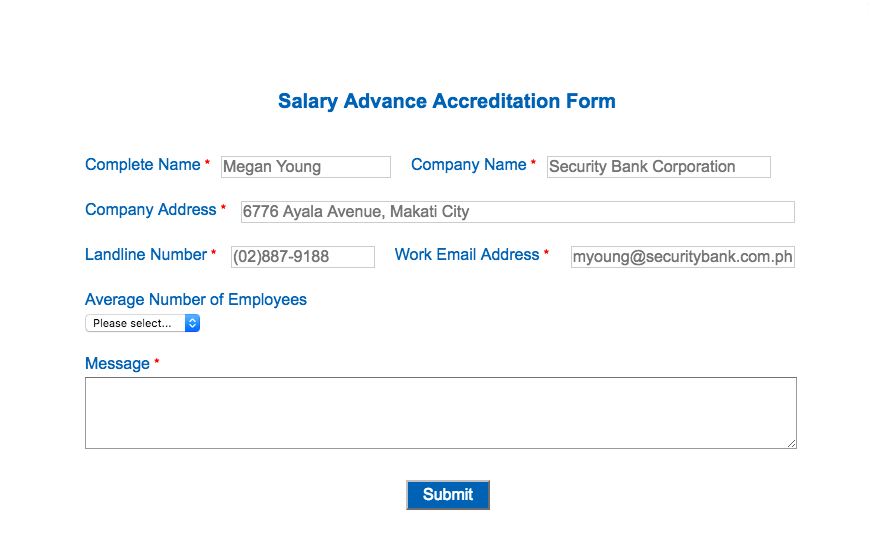

Application: the first step in the official mortgage approval techniques; this form is utilized to help you list important info regarding prospective debtor needed seriously to the newest underwriting process.

The newest month-to-month number is based on the latest https://clickcashadvance.com/payday-loans-co/portland/ schedule for your name otherwise amount of the mortgage

Appraisal: a file off an expert providing you with a price from an excellent property’s fair market price according to the conversion process off comparable residential property in the region plus the options that come with a house; an assessment could be required by a lender before financing recognition to make certain that the borrowed funds loan amount is not over the value of the house.

Assumable Financial: when a home is available, the seller could possibly transfer the borrowed funds with the the latest consumer. It means the borrowed funds was assumable. Lenders basically need a card post on new debtor and you will may charge a fee for the belief. Specific mortgages contain a because of-on-purchases term, which means the mortgage may not be transferable in order to good the buyer. As an alternative, the financial institution could make you pay the complete balance that is owed when you offer your house. A keen assumable home loan can help you appeal customers for people who promote your property.