The latest Yearly Financial Remark: The reason why you You want One

What You will learn

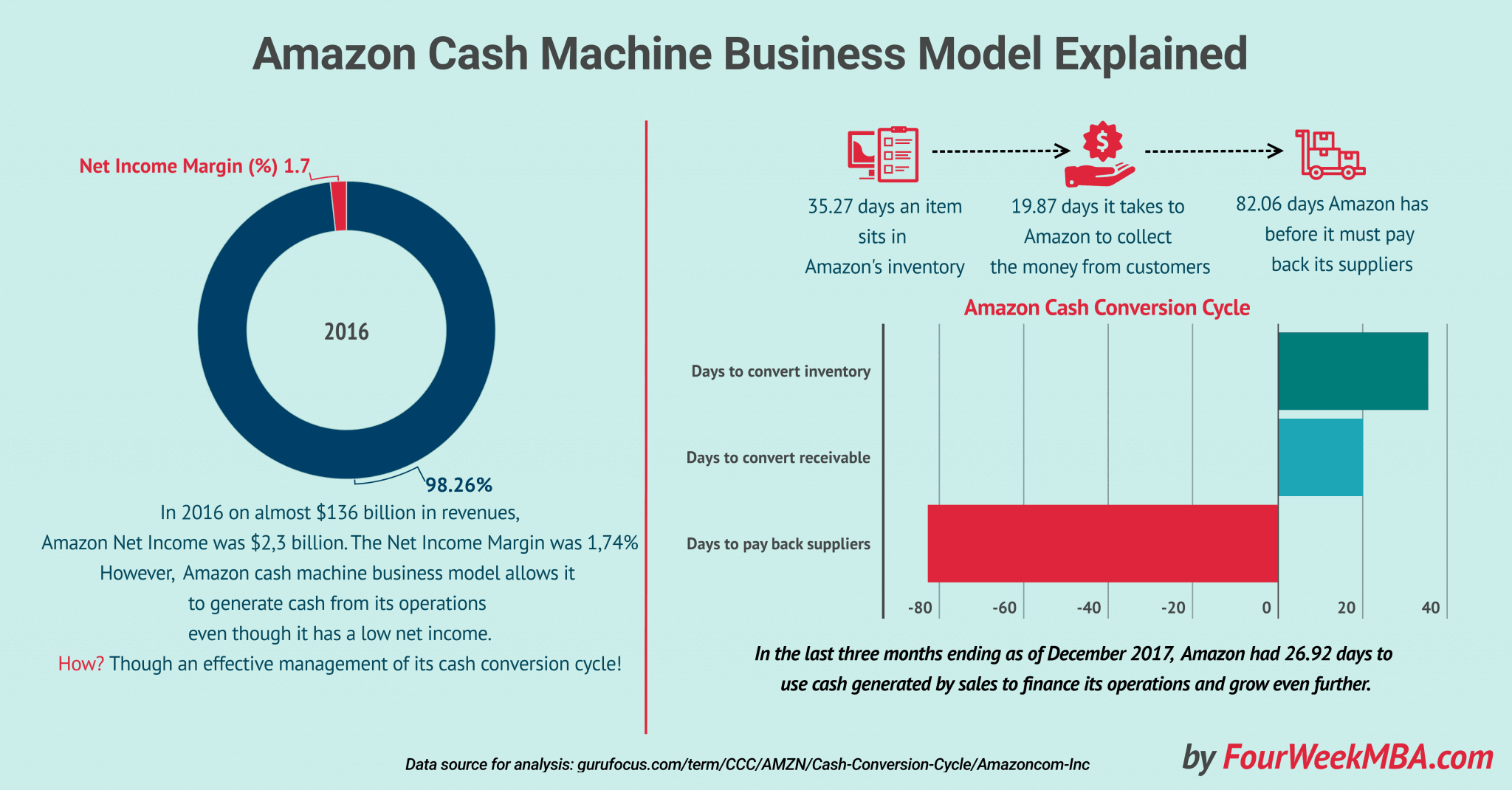

We’ve all payday loans Branchville heard these two terminology in advance of. Too-soon. However you know what cannot already been eventually? Saving thousands of dollars over the course of the loan by scheduling a mortgage feedback Today. Even in the event you’ve has just ordered property, it is never ever too quickly in order to meet along with your financial to make sure your loan nevertheless suits your life style and you can coming plans. Their house’s guarantee The essential difference between exacltly what the residence is really worth and your debts on your home loan. equity The essential difference between exactly what your home is really worth and you will just what you borrowed on the mortgage. you may bring fantastic refinancing solutions, and also shed light on a method to save very well their financial.

What exactly is a mortgage Feedback?

Think about home loan studies due to the fact kind of like a great checkup with your physician. Except in such a case, a family doctor isn’t a physician. they might be your area Financial Banker. In place of putting a frost-cold stethoscope with the chest otherwise striking their lower body which have a beneficial hammer for the majority of unusual reasoning, which checkup is focused on strengthening your finances.

When you plan a complimentary home loan review (regardless if your mortgage isn’t that have Atlantic Bay), we are going to look closer at your current economical situation, earnings, personal debt, and you may requirements to be sure your own home loan has been doing what its supposed to would be sure to possess a happy domestic that give shelter and stimulates generational wide range to you plus family unit members.

We advice creating an evaluation all one year, nonetheless it would not harm so you’re able to workshop the financial and you will wants that have your bank more than one particularly if there’ve been a critical improve in your lifetime, eg marriage otherwise a living changes, or if you possess a massive then expense just about to happen.

Financial Feedback Benefits

Mortgage critiques can limelight coupons possibilities, offer up-to-day information regarding today’s loan solutions, plus opinion your credit report to confirm reliability. Listed below are just a few of the advantages of arranging an effective review:

Straight down Money

You could be eligible for a lowered interest compared to the you to definitely the loan already sells, or maybe you’ve dependent sufficient collateral (there can be one to word once more) to end private mortgage insurance (PMI) Plans you to handles the lender should you standard on the mortgage. Home loan insurance is you’ll need for FHA financing and Antique financing when you establish lower than 20%. personal financial insurance coverage (PMI) An insurance policy you to covers the lender in case you default on your own loan. Financial insurance is necessary for FHA fund and also for Conventional funds after you put down lower than 20%. .

As soon as your mortgage-to-really worth (LTV) The difference between the mortgage number and house’s market value. It will help loan providers determine mortgage exposure. loan-to-value (LTV) The essential difference between the mortgage amount plus the home’s market value. It will help lenders evaluate financing risk. ratio drops to help you 80%, you can consult PMI cancellation. This means you have 20% security of your home. If you have made your loan costs timely, you need to struck which count on a romantic date pre-computed on the PMI revelation and included with their paperwork when you closed the loan. The lender or servicer ought to be able to supply you with with this time, any time you need to know sooner than your own annual review.

Faster Label

Of many loans end up in the category away from 31-season repaired name, however one to a while has passed while the acquisition of your house, a smaller title is generally right for you. A smaller mortgage term may help you pay back your debts reduced and you will save money on appeal fees over your loan’s lifetime.

Professional Tip

Refinancing so you can a smaller label will mean high monthly premiums, as well as your newest earnings need to be sufficient to qualify for the fresh the brand new financing. Although not, you can purchase a better speed, and you might however save money within the attract across the life of the loan.

Cash out

Sitting yourself down with your bank you will definitely show that you really have dependent adequate security of your property in order to refinance and use the funds with the most other expenditures. Don’t’ care, we will determine.

An earnings-aside re-finance is a type of refinancing the place you capture out a totally the, large mortgage to displace your own modern mortgage, and you pocket the real difference in the closing. Extent you receive hinges on the collateral, economic character, and mortgage program.

A finances-away refi may help in many ways, particularly whenever a big resolve is necessary, a major life experience occurs, or you just want to most useful debt upcoming by paying of high-rates obligations. Stay the info Cardiovascular system for additional information on applying for a finances-aside re-finance please remember it’s never too-late so you can re-finance.

A unique Mortgage?

You never know? There can be a possibility you to definitely a home loan remark you certainly will reveal that you might be in a position to remove one minute mortgage to possess an investment property or vacation home. Because a homeowner, you have already knowledgeable the borrowed funds process once, however, obtaining (and you may managing) a second loan would be somewhat different and you can yes includes its own challenges and you can advantages. Seek the advice of your own Mortgage Banker thoroughly before deciding.

Comfort

Both, a home loan review will get show that your loan and all their accoutrements are great for your role. You have the most useful rates, title, and fee number you can easily, and you are focused to conference your financial specifications. If so, great! Anybody can provides believe that your particular paying habits is actually efficient as well as your money is not taking lost every month.

Prepared to take a closer look at your home loan? Get reassurance sooner or later, not afterwards, and you will agenda your comment now!