Documents Needed for home financing Pre-Approval in Texas

You have made the choice to pick a home inside Colorado along with heard that delivering investment pre-recognition is the better topic you want to do before you actually initiate home browse. It truly is great advice about several secret grounds.

First, you will be aware the exact finances within your arrived at and thus helping you save plenty of $255 payday loans online same day Hawai rage and you will big date. And you will second, when you get pre-approved, manufacturers may take you surely which means end up being way more willing to enter into genuine negotiations.

What data files want to score home financing preapproval from inside the Georgia?

Prior to heading out over the bank, you will need to provides specific records to possess home financing pre-acceptance for the Colorado.

step one. Proof Earnings and you will A job

You’ll naturally must show lenders that you aren’t simply employed as well as your earnings will do enough to have you to definitely take care of the home loan repayments each month.

The type of data you’ll need for financial pre-acceptance for the Texas depend on your own a job state as well as the manner in which you try paid off. However, in virtually any circumstances, you will likely be required to offer duplicates of your earlier 2 years’ income tax output, one another state and federal.

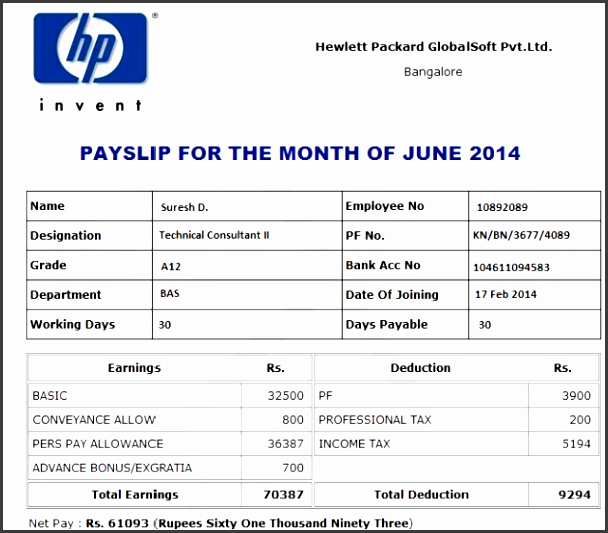

- Salary Earners as well as the Salaried: Copies of history pair pay stubs and more than previous dos years’ W-dos versions including facts of incentives and you will overtime.

- Self-Working People (Freelancers and you can Separate Designers): Profit-and-losses statements as well as the last few years’ Mode 1099. And also this comes with S-providers, partnerships, and sole proprietorships.

If you have any, you will additionally be asked to bring proof a house earnings. If it’s accommodations assets, you happen to be expected to deliver the property’s market value along which have evidence of local rental money.

dos. Info off Possessions

A listing of possessions is another of your own data you will have to enable home loan pre-approval when you look at the Texas. For each and every savings account (savings, examining, money industry, an such like.) you will require duplicates with a minimum of 60 days’ value of comments.

Also, you want the latest statements over the past 8 weeks getting all your valuable investment membership such as for example Dvds, brings and you can bonds. You should also be ready to deliver the most current every quarter statement demonstrating the fresh vested balance for your 401(k)s.

step 3. Selection of Month-to-month Loans Payments

Lenders will definitely want to know just how much you pay away monthly to cover the money you owe. So, you may be necessary to promote authoritative suggestions out of monthly obligations-percentage obligations eg student education loans, most other mortgage loans, car loans, and you may credit cards. Loan providers will demand one provide for each and every creditor’s name and you can target, and the account balance, minimal commission, and financing harmony.

When you find yourself already renting, you’ll likely be asked to give book-commission receipts over the past one year. Be sure getting prepared to offer landlord contact info to own even the past couple of years.

4. Details of Most other Costs and you may Monetary Situations

Other records that will be part of the data files you’ll need for financial pre-approval inside Colorado are those useful recording particular lifestyle-enjoy expenditures. As an instance, if you’re separated, just be prepared to offer judge orders to own child support and alimony costs. When you have stated bankruptcy otherwise been through foreclosure, you are expected to provide relevant data files.

Let me reveal one to latest consider. Loan providers will often concern your exactly how you plan to pay for new down-payment to your assets. Therefore, remember that you are required to tell you proof new sourced elements of currency for the purpose.

Being pre-acknowledged to own money would depend mainly towards the files you give as soon as you really have complete one, you can continue your residence-google search excursion.

If you’d like to learn more about an informed a means to get pre-acknowledged together with other investment selection, contact of the mobile during the or by completing your own short estimate!