Regarding credit rating point of view, which matter are going to be 29% otherwise lower

Your borrowing from the bank use ratio , which suggests how much cash of one’s available rotating borrowing balance you’ve utilized, provides a thirty% weightage in your credit history. Such as for example, for those who have around three credit cards that have a blended harmony out of $15,000 and you can owe a maximum of $eight,five-hundred, your own borrowing from the bank utilization ratio is fifty%.

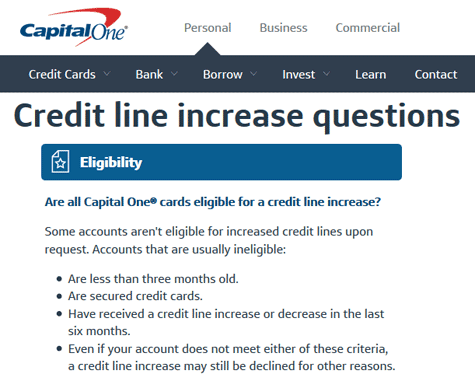

Whether your credit usage ratio is over 29%, just be sure to pay as much of your personal debt you borrowed from to bring that it matter off. Getting it to over 10% is the best if you want to change your credit history. A different way to improve your credit usage ratio should be to inquire your own credit card providers to boost their borrowing limit. Yet not, it is better you abstain from using a whole lot more borrowing from the bank until you make an application for home financing.

Develop Delinquencies

Fixing a charge card delinquency such as destroyed a fees are fairly easy however, overlooking one costs more a long period might possess big effects. Due to the fact issuer of your own credit have a tendency to intimate your account, your debt may end with a portfolio company and you also you’ll risk against garnishment of your earnings . Besides, their mention you will stay on your credit score for eight many years.

Paying down loans which is having a collection company have a confident affect your credit rating with respect to the model into the question. When you have major delinquency, you should ideally begin making payments as soon as possible. Get in touch with the brand new issuer of your credit to check whether it features any difficulty program. Envision paying the debt if you’re ok that have making a swelling share percentage. Contacting a card counseling service to acquire toward a loans government package can also be a choice.

Dont Intimate Old Levels

The size of your credit score has a great ten% weightage on your credit rating, together with prolonged it is, the greater. Because of this, if you have one old account you plan to shut, reconsider that thought since the this may have a detrimental impact on your own credit history’s duration https://www.paydayloanalabama.com/trinity. Closure a comparatively the newest membership, on top of that, will not have once the damaging a direct effect.

Do not Sign up for The fresh Credit

The latest borrowing makes up 10% of one’s FICO score, and every big date your submit an application for the fresh new borrowing, your credit score falls by the a number of things. This is why, it is better that you don’t sign up for any form of borrowing from the bank unless you ensure you get your credit rating on track.

Completion

With terrible creditworthiness and you will a reduced credit history could work as a good dampener when you need to get a mortgage. This is because loan providers check individuals from this bracket while the large-exposure consumers. In addition to, even if you be eligible for a home loan, your credit rating however plays a role in the interest rate you earn. When you have the common credit history, you can thought boosting it before applying for home financing since it will pave the way in which to have a better contract.

Now that you understand aftereffect of credit scores for the mortgages, determine if yours excellent enough to sign up for a house mortgage. If that’s the case, imagine contacting a mortgage vendor to determine for individuals who be eligible for preapproval. Your ount for which you qualify.

The latest payment on a beneficial $three hundred,000, 30-seasons fixed rate loan during the 6.50% and 75% loan-to-worthy of (LTV) are $step one,. The new Annual percentage rate (APR) was 5.692%. Payment doesn’t come with taxation and insurance costs. For folks who include fees and you will/or insurance rates into the mortgage payment then your actual fee commonly end up being better. Some state and condition restriction loan amount limits ple that will be to possess illustrative intentions merely.